A business owner uses cash basis accounting." />

A business owner uses cash basis accounting." /> A business owner uses cash basis accounting." />

A business owner uses cash basis accounting." />

Cash basis accounting can help you simplify your accounting processes. Running a business is hard enough already. Cash basis accounting can streamline your accounting system and save you time—you just have to know how to navigate it.

Here, we’ll help you understand what cash basis accounting is, how it differs from accrual accounting , and its advantages and disadvantages.

Cash basis accounting is an accounting method that records and tracks financial information by the actual flow of cash in and out of a business. In other words, it only records income when you receive or pay cash.

The cash basis of accounting is easier to understand than other accounting methods because it focuses on cash transactions only. It also requires fewer journal entries in your accounting ledger .

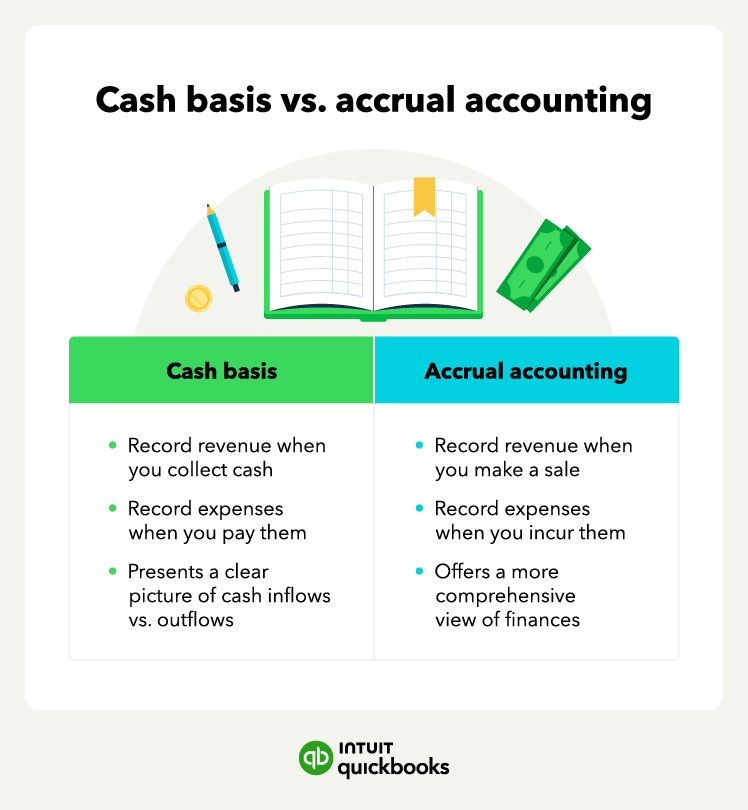

When it comes to choosing between cash basis and accrual accounting, there are many factors to consider. Cash basis accounting is simpler to understand and requires fewer journal entries. If you have a rather simple business with only minor fluctuations in cash flow, then cash basis accounting may work well.

Accrual accounting records income or expenses as soon as they are incurred, regardless of when payment is made or received, and this can provide a more accurate picture of the company’s financial health. An accrual-based system may better meet your needs if you have inventory, accounts payable, or need more detailed financial information.

Note that corporations with average annual revenues of over $26 million for the previous three tax years must use accrual accounting.

An example of cash basis accounting would be a small retail store that purchases products from a supplier. The store would recognize the expense only once the product payment has been made rather than when they receive the goods.

Another example of cash basis accounting would be a service-based business that provides services to its customers on credit terms. In this case, the income would only be recognized once payment has been received from the customer.

Or consider the following transactions for your business:

Here’s how the accounting journal entries would look in the accounting books:

Also note that companies using cash basis of accounting will have simpler financial statements. For example, here’s a cash basis income statement:

Revenue and expenses will only appear on a cash basis income statement after money exchanges hands. The balance sheet includes assets, liabilities, and equity but not inventory, payables, or receivables. Here’s an example:

And finally, the cash flow statement uses cash basis accounting—even if you use accrual accounting. Here’s what the cash flow statement looks like for our example company:

Note that the net income from the income statement carries over to the cash flow statement, and the cash at the end of the year on the cash flow statement matches the cash figure on the balance sheet.

Cash basis accounting is relatively easy to use and maintain, which makes it an attractive option for small business owners and individuals without extensive accounting knowledge. They can track their financial transactions based on cash inflows and outflows without the need to track accounts receivable or payable.

Focusing on the actual cash you receive and pay provides a clear picture of a company's cash flow. This clear picture is particularly important for small businesses and startups that must closely monitor their cash position to ensure they have enough funds to cover expenses and support growth.

Your accounting software can help you with cash flow reporting, such as generating cash flow statements .

Cash basis accounting may provide tax advantages for small businesses. Businesses using cash basis accounting only report income when they receive it and expenses when they pay them.

This approach can result in deferring tax liabilities , as income recognition may occur in a later tax period, potentially giving the business more time to use those funds for growth or other purposes.

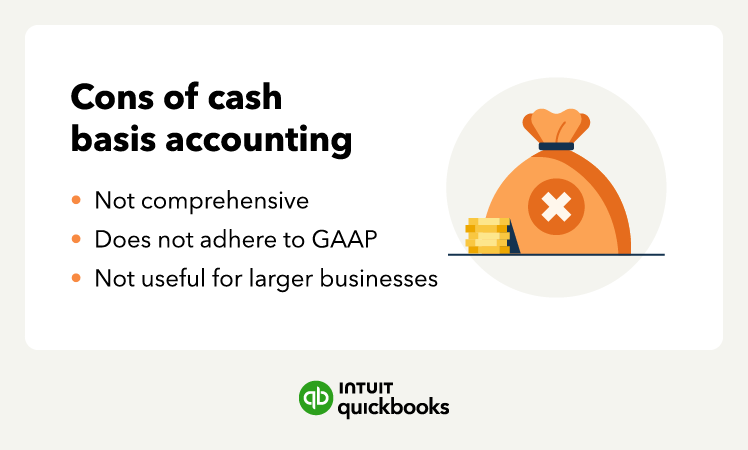

Cash basis accounting has its advantages, but it also carries some drawbacks. Although tracking expenses on a cash basis makes it easier to understand the immediate financial situation of a business, this system does not provide an accurate picture of long-term profitability or financial health.

So, when should you use the cash basis of accounting? Cash basis accounting is usually unsuitable for businesses looking to secure financing or manage investments, as lenders and investors prefer to see accrual-based records.

Cash basis accounting recognizes revenues when cash is received and expenses when cash is paid. This can lead to an inaccurate representation of a company's financial health, as it does not account for revenue earned but not yet received or expenses incurred but not yet paid.

As a result, a company's financial statements may not accurately reflect its true financial position, making it difficult to assess its performance.

Cash basis accounting does not adhere to the Generally Accepted Accounting Principles (GAAP), widely recognized accounting standards that govern financial reporting in the US.

Most businesses are required to follow GAAP, especially if they are publicly traded or seeking investment. Using cash basis accounting can limit a company's ability to attract investors or secure financing, as it may not provide a comprehensive and accurate picture of the business's financial health.

Cash basis accounting is suitable for small businesses with simple transactions and few accounts receivable and payable. However, it may not be the best choice for larger businesses or those with more complex financial transactions.

Larger companies typically have more intricate financial operations, such as inventory management and long-term contracts, which require accrual accounting to accurately reflect their financial performance.

Additionally, cash basis accounting makes it challenging to analyze financial trends and make informed decisions about a company's future growth and profitability.

Cash basis accounting can be a great way to streamline your accounting and save time. It allows you to easily track cash flow and better manage your budget. By eliminating the need for tracking accounts receivable and payable, businesses can also save time preparing their taxes.

Overall, cash basis accounting is a great way to simplify your accounting software needs.

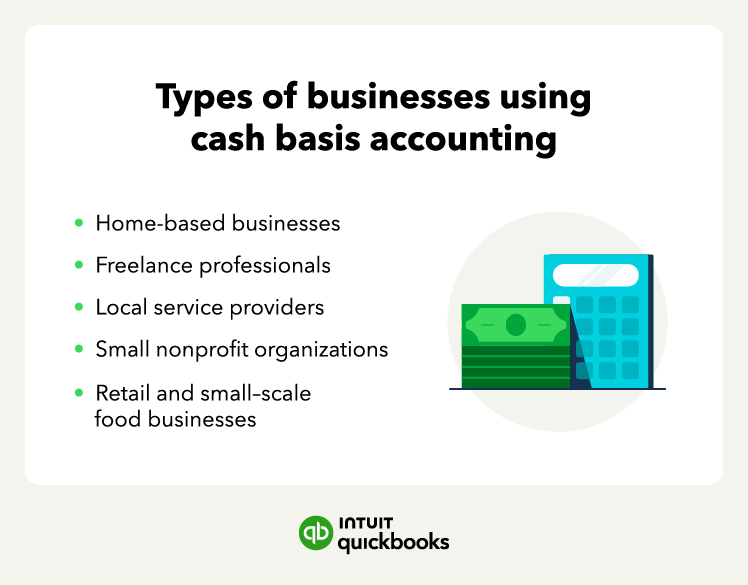

Cash basis accounting is an attractive option for many businesses as it simplifies the process of tracking income and expenses. This accounting method is commonly used by small businesses, sole proprietorships, startups, and self-employed individuals.

How does cash basis accounting simplify tax preparation?Cash basis accounting simplifies tax preparation since only the actual amounts you pay or receive are reported on taxes. By eliminating the need for tracking accounts receivable and payable, businesses can save time preparing their taxes by not having to reconcile them with their financial statements.

How do you calculate cash basis in accounting?Calculating cash basis in accounting is quite straightforward—just track the actual amounts of money your business received and paid out over a given period. If a business makes $10,000 in sales during the month but only receives $5,000 in payments, then its income would be reported as $5,000 for that month instead of the full $10,000.

You're never too small, and it's never too soon to know you're on track for success.

Start here Recommended for you

Cash flow projections: What they are and why you need them

February 1, 2023

8 accounting formulas every small business owner should know

A business owner assessing their company's cash flow." />

A business owner assessing their company's cash flow." />

Cash flow guide: Definition, types, how to analyze

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

**Product information

QuickBooks Live Assisted Bookkeeping: This is a monthly subscription service offering ongoing guidance on how to manage your books that you maintain full ownership and control. When you request a session with a Live Bookkeeper, they can provide guidance on topics including: bookkeeping automation, categorization, financial reports and dashboards, reconciliation, and workflow creation and management. They can also answer specific questions related to your books and your business. Some basic bookkeeping services may not be included and will be determined by your Live Bookkeeper. The Live Bookkeeper will provide help based on the information you provide.

QuickBooks Live Full-Service Bookkeeping: This is a combination service that includes QuickBooks Live Cleanup and QuickBooks Live Monthly Bookkeeping.

1. QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time. 37% faster based off of internal tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow.

2. Access to Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Desktop Enterprise or QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

3. For hours of support and how to contact support, click here.

4. With our Tax Penalty Protection: If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. See more information about the guarantee here: https://payroll.intuit.com/disclosure/.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Money: QuickBooks Money is a standalone Intuit offering that includes QuickBooks Payments and QuickBooks Checking. Intuit accounts are subject to eligibility criteria, credit, and application approval. Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. QuickBooks Money Deposit Account Agreement applies. Banking services and debit card opening are subject to identity verification and approval by Green Dot Bank. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Commerce Integration: QuickBooks Online and QuickBooks Commerce sold separately. Integration available.

QuickBooks Live Bookkeeping Guided Setup: The QuickBooks Live Bookkeeping Guided Setup is a one-time virtual session with a QuickBooks expert. It’s available to new QuickBooks Online monthly subscribers who are within the first 30 days of their subscription. The QuickBooks Live Bookkeeping Guided Setup service includes: providing the customer with instructions on how to set up chart of accounts; customized invoices and setup reminders; connecting bank accounts and credit cards. The QuickBooks Live Bookkeeping Guided Setup is not available for QuickBooks trial and QuickBooks Self Employed offerings, and does not include desktop migration, Payroll setup or services. Your expert will only guide the process of setting up a QuickBooks Online account. Terms, conditions, pricing, special features, and service and support options subject to change without notice.